The right side of markets

“If you see the

poor oppressed in a district, and justice and rights denied, do not be

surprised at such things; for one official

is eyed by a higher

one, and over them both are

others higher still.”

Ecclesiastes 5:8

Welcome to 2024. What a year 2023 was! Everybody bearish. “This is a counter trend rally.” “It’s gonna crash.” “This is the big one.” “The $ is toast.”

|

Bad news sells. It’s easy to let yourself being seduced by negativity. The guys behind it are sometimes very smart people, experts in how the system works, people I respect a lot.

Their stories are mostly very well build. Their data backing it up is accurate. And if you ever blindly fell for them, don’t worry, I’m as guilty as you are. My path towards more wisdom in markets was filled with many holes and I still have a long way to go.

But what is that exactly “wisdom in markets”? Maybe we better first start with defining what a market is. Think about this for a second. Let’s say the gold market. Buyers of gold place a bid. Sellers place an ask price. When these prices meet we have a settlement. The clearing process sets the new price all within nanoseconds. This show runs 24/7. I say 24/7 because markets run all the time even when they are closed. Or do you think buyers and sellers of gold do not think about their gold positions and come up with new ideas, knowledge, insights and strategies over the weekend?

From psychology we know that logic makes people think and that emotions make people act. You may think you decide based on what you know but that is just an excuse to comfort your mind for what you are about to do. What makes you push the buy or sell button is emotion. Always! Think about that for a minute. So market participants read, study, think, talk and brainstorm about markets, come up with their knowledge, strategies and ideas from which their emotions are born and then based on these feelings they push the buy or sell button or do nothing. A market in it’s essence is the electrocardiograph of the consolidated emotions of all market participants passing through time. Constantly changing, adapting, growing or shrinking almost like a living organism. All the consolidated knowledge and expertise and following emotion of a market is discounted in price real time at all times.When markets are closed these processes continue and when substantial changes in these consolidated emotions happen over the weekend markets open with gaps. Truly amazing right? Are you beginning to grasp how difficult it must be to predict the future path of such an electrocardiograph? Is it not understandable that even very smart analysts often fail in seeing the next move in markets, let alone predict major highs or lows? Off course it looks impossible. Because it is impossible ... from a human perspective. You’re going to need something much bigger, something of the hand of God.

And here we go. The moment you say “God” you reach the point where many stop reading. The Danielcode taught me that this is the starting point where true knowledge about markets comes from. Stick with me and you will not be disappointed. I’m am not going into details here on what the Danielcode is or how it works. There are plenty of articles written on that, freely available on the Danielcode website. I urge you to read them. If one of them inspires you, you will read them all. (www.thedanielcode.com)

The basic idea is that markets are ruled by time cycles calculated out of the mathematical DC matrix that originates from the book of Daniel (Old Testament). The idea is preposterous, I know, but the reality sure is not. Markets make highs and lows only when one or multiple DC time cycles expire. Without exception. Time controls the whole show. Show me any market and I will show you the time cycles at the highs and lows at which that market has turned lower or higher. Markets have a DNA. They have a rhythm, they are organized and sometimes even predictable. They speak to you in Danielcode language. If you understand the language you can see things few people can. The key variable of their language is TIME. And it is really much easier to learn to draw DC time cycles than it is to believe in the concept. Drawing them is easy, understanding what they mean and how they will likely affect a market demands experience. Repetition and study builds skill. Time rules any market and when you realize that price is just an invention by us, manipulated by the powers that be, where even the price of money is manipulated, it actually makes sense that only a heavenly and immovable variable like time can have any influence in it.

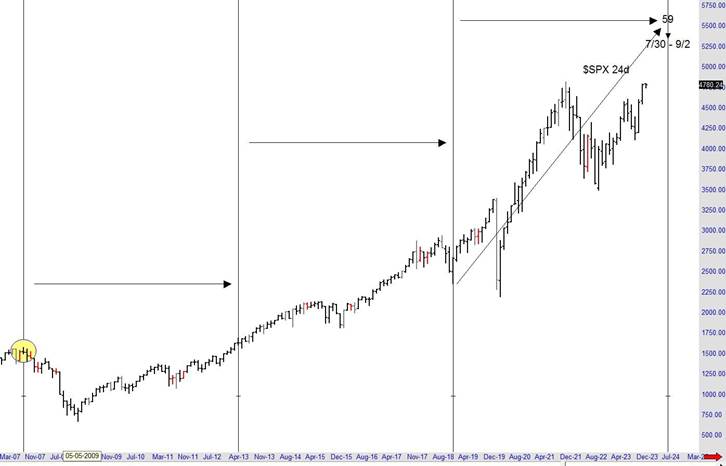

1. Why the top early 2022 was not the end of the bull market

People who read the 4th seal knew very soon after the top in $SPX January 2022 that it was not the end of the bull market. We knew because we did not have the proper DC cycle setup to cap the amazing bull market since March 2009. We did have a 62 cycle top on that high and we did expect a correction, but not the end of the long term rally. I know the following decline was bad, I know that the bearish story was compelling, I know there was war and inflation, I know that nobody believed the possibility of new highs but I also knew that only the right DC time cycle setup can end this bull market. Markets are ruled by DC time cycles. Always!

An inverted 62 cycle top gives us a correction which as soon as the next DC cycle comes up is a candidate for reversing back up. It took a few months but the 44 cycle low in October 2022 did the trick and the market made a swing low when nobody expected it. By now you probably think I’m a lunatic looking for market turns through the divine powers of time but I wouldn’t dare to use anything else.

The sole reason why the SPX made that top early 2022 is because the DC 62 time cycle expired. All the technical, macro, monetary and many other explanations as to why it topped there first of all came after the fact and basically are nothing more than a seemingly intellectual way to satisfy our rational thinking minds to understand why happened what happened. The same goes for the swing low. It took the 44 cycle low to end the decline nothing more.

Now, I can talk all I want about he past, it will and should not impress you. At best it should get you interested. Predicting the past is a piece of cake. Doing the same with the future is something else. What you want to know of course is when this amazing bull market that started in March 2009 will end. The only honest answer any expert should give you is “I don’t know”. We have no foreknowledge about the future. That is the privilege of God only. But that does not mean there are no Danielcode clues. In fact Danielcode charts are full of clues. You just need some knowledge/skill and lots of belief to read them.

2. The epic bull market

During the countless predictions of doom in 2023 we stayed bullish. We still are. DC cycles tell us that the party is not over. Not yet. This bull market is very strong, almost epic and usually they do not die easily. However I’m convinced that it will top on a DC time cycle and we will see the setup. The question is if I’m experienced enough in the DC time cycles to know which of the DC time cycles will cap this long term rally. In 2022 we had a major DC topping cycle on all time frames (6 day, 12 day and 24 day charts) but it did not setup properly which took us a few months to confirm (24 trading days is a month) but we turned bullish again immediately thereafter. In 2023 there was also a topping cycle but since the market was not yet at new highs when the cycle expired this one too could not end this bull market. Let me walk you through the topping cycles for $SPX for 2024.

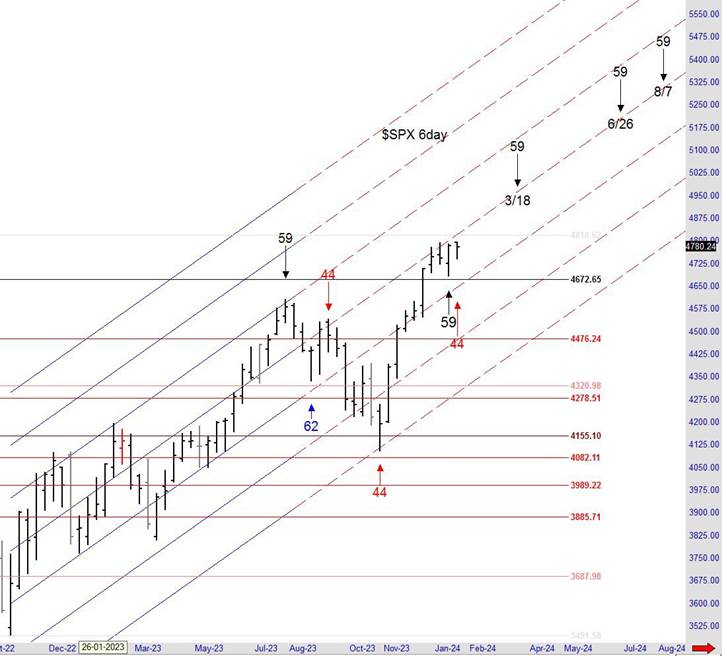

The chart is on the next page. We are looking for a 59 cycle to expire because that is what we need to cap this bull market. These cycles are calculated starting from swing highs or lows from previous moves in the market. This is done on 6 trading day charts where each bar is 6 trading days and we look for confirmation of the cycle on the 12 day and 24 day charts. The first 59 cycle that pops up expires on March 18. It originates from the October 2022 swing low. Looking deeper into it we soon realize that this cycle does not show a similar vibration possibility on the 12 day chart and 24 day chart for the same time window. This means the other time frames do not confirm the 6 day cycle. That makes this cycle a less likely candidate to cap the epic bull market. We are looking for at least a confirmation on the monthly (or 24 trading day) chart.

The next 59 cycle top expires on June 26. This cycle originates from the January/February 2023 swing high. After examination we notice that this cycle vibrates also on the 12 day chart with a 59 cycle originating from the August 2021 high. But again in it’s disadvantage is a lack of vibration on the 24 trading day chart. I consider this important since major tops especially of an epic bull market as this one should vibrate on the longer term charts. Not having a topping cycle on the 24 day chart decreases the odds of this cycle to do the trick. That does not mean these cycles will not vibrate when they expire but we do not know how they will yet, we just know they will probably not kill the bull.

3. The heart of the matter

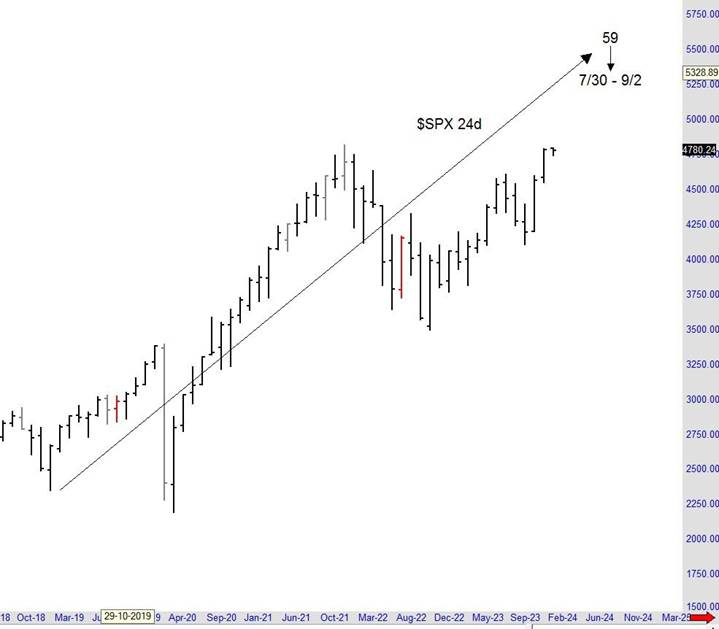

The next cycle in line is the 59 cycle top expiring on August 7. This cycle originates from the March 2023 swing low which is the first valid swing low (correction of 3 or more bars) after the big swing low in October 2022. This is very important. The low after or before the low and the high after or before the high are always important signposts in markets from which powerful time cycles can originate. That is a big plus for this cycle. Looking at the 12 day chart here too we see a vibration with the September/October 2021 swing low. Another plus. It gets better. On the 24 day chart we have a similar 59 cycle running from 7/30 to 9/2 2023. The chart is on the next page.

The 6 day and 12 day 59 cycle tops fall in the early part of the 59 cycle top on the 24 day chart which is perfect. On top of that this 59 cycle top comes from the January 2019 swing low which is the major swing low before the Covid crash low. Again perfect. Always watch the low before and after the low. These moments in markets are paramount for future market moves.

Looking at these cycles I’m seeing a major high coming. What I just shown you is forensic data that early August 2024 is a date to watch like a hawk. Markets are ruled by time and time only. They can not top without a DanielCode time cycle properly setting up. As we move closer to the date we will know with more certainty whether that setup validates or invalidates. In the case of the latter it just means that the bull market will last longer. In the other case we should see the top coming with the precision of a week. I’m not kidding you. Mind you though that there are about 6 market holidays between now and August in $SPX so these time frames and dates need to be moved up by 6 trading days into the future.

Now let me take this one step further. Look at the 59 cycle top on the 24 day chart. This cycle vibrates with the 2007 top right before the global financial crisis in 2008. Do you remember that one?

Danielcode time cycles are very important in markets. Very! Markets have a memory! They have a DNA. They are structured around the Danielcode matrix in both time and price. Time cycles that forecast major highs and lows in markets sometimes run for decades. The market knows them. And if you believe this stuff and do the hard work of examining you know too. That is the gift of the Danielcode. But you only receive it after you believe; which is, I promise you, the hardest part.

Now what did we learn. First of all we need to keep an eye on August this year. It’s a very good candidate to end the epic bull market. Secondly this also means we need to stay bullish for now. Time cycles are like magnets. They will pull the market higher right into the moment they expire. Then and only then the market is ready to turn. So forget the countless recession forecasts for now and focus on Danielcode TIME. Thirdly I promise you we will be on top of this story during 2024 with our weekly updates. We will see more and more forensic evidence of the cycle piling up giving us very good indication whether it will top as we move into August. Once we get there we will know.

I also want to warn you. Looking at the chart above it’s hard not to see how epic this bull market in equities is. The fallout could be equally epic. Be careful and fear these time cycles.

They are powerful beyond your imagination. A lot of excesses have been build up since March 2009 and they are at risk a soon as a DC time cycle bites. Also realize that markets top in tricky ways, fooling you into believing they will go higher. I have no idea how the SPX will top but this article now gives you the first next opportunity as to WHEN it could/should happen.

One more warning. It is not our job to become prophets nor do I want to emulate what Isaac Newton described as “the folly of interpreters”. I’m just the messenger here. I read the Danielcode numbers on financial charts. I look at financial markets through Danielcode lenses and try to translate what it is telling in plain English. I encourage you to study this stuff. I promise you, you will be amazed. Markets are ruled by the Danielcode. Markets move within the boundaries of Danielcode numbers and make turns on Danielcode time cycles. If we want to know what is ahead we have to listen what it is telling us. The only limitation that the Danielcode has in forecasting markets is our ability to decipher it.

“The fear of the Lord is the beginning of wisdom; all those who practice it have a good

understanding”

Psalm 111:10

Isaac Newton knew that there was major knowledge hidden in the Book of Daniel. He gives us solid warnings.

jneedham@thedanielcode.com support@thedanielcode.com

Frank De Baere Belgium January 2024

PS A big thank you to my mentor JC Needham who taught me this stuff. I study the DanielCode like a hawk watching it’s prey. It’s been an amazing journey. Thank you my friend.

Disclaimer: All the reports, charts and content in the Danielcode web site are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author only and should be treated as such. Before acting on any of the ideas expressed, the reader should seek professional advice from a licensed broker in the appropriate jurisdiction.

Risk Disclosure for Front Page, Long Term Trend Charts: THE RISK OF LOSS TRADING COMMODITIES OR FUTURES CAN BE SUBSTANTIAL. COMMODITY TRADING HAS LARGE POTENTIAL RISKS, IN ADDITION TO ANY POTENTIAL REWARDS. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES OR COMMODITIES MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. THIS IS NEITHER A SOLICITATION NOR AN OFFER TO BUY OR SELL COMMODITY INTERESTS. THE USE OR PLACEMENT OF ANY STOP-LOSS OR STOP-LIMIT ORDERS MAY NOT LIMIT YOUR LOSSES AND YOU COULD LOSE MORE THAN YOUR INTENDED AMOUNT OF MONEY AT RISK. PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT INDICATIVE OF FUTURE RESULTS.

Risk Disclosure for Genie Results, T.03, T.03+ and TradeProgram: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.